Insurer

An Insurance policy for a mid-sized vehicle with a 1.5L engine costs roughly Rs. 35,000 at a Dealer. However, same coverage is Rs. 26,000 from alternative sources.

Car manufacturers and insurers collaborate to create policies which control service and claims, in addition to premiums and payouts. These policies pass through the Dealers, who possibly make more money selling insurance than they do selling automobiles.

Insurers’ cost of processing the claim is increasing. They incur additional costs due to the restricted availability of spares, which prolongs the repair turnaround time. Insurers are also spending more on repairs at the Dealers compared to Independent Garages.

Challenges Today

Why it matters to you?

Life After Fair Repair

Challenges Today

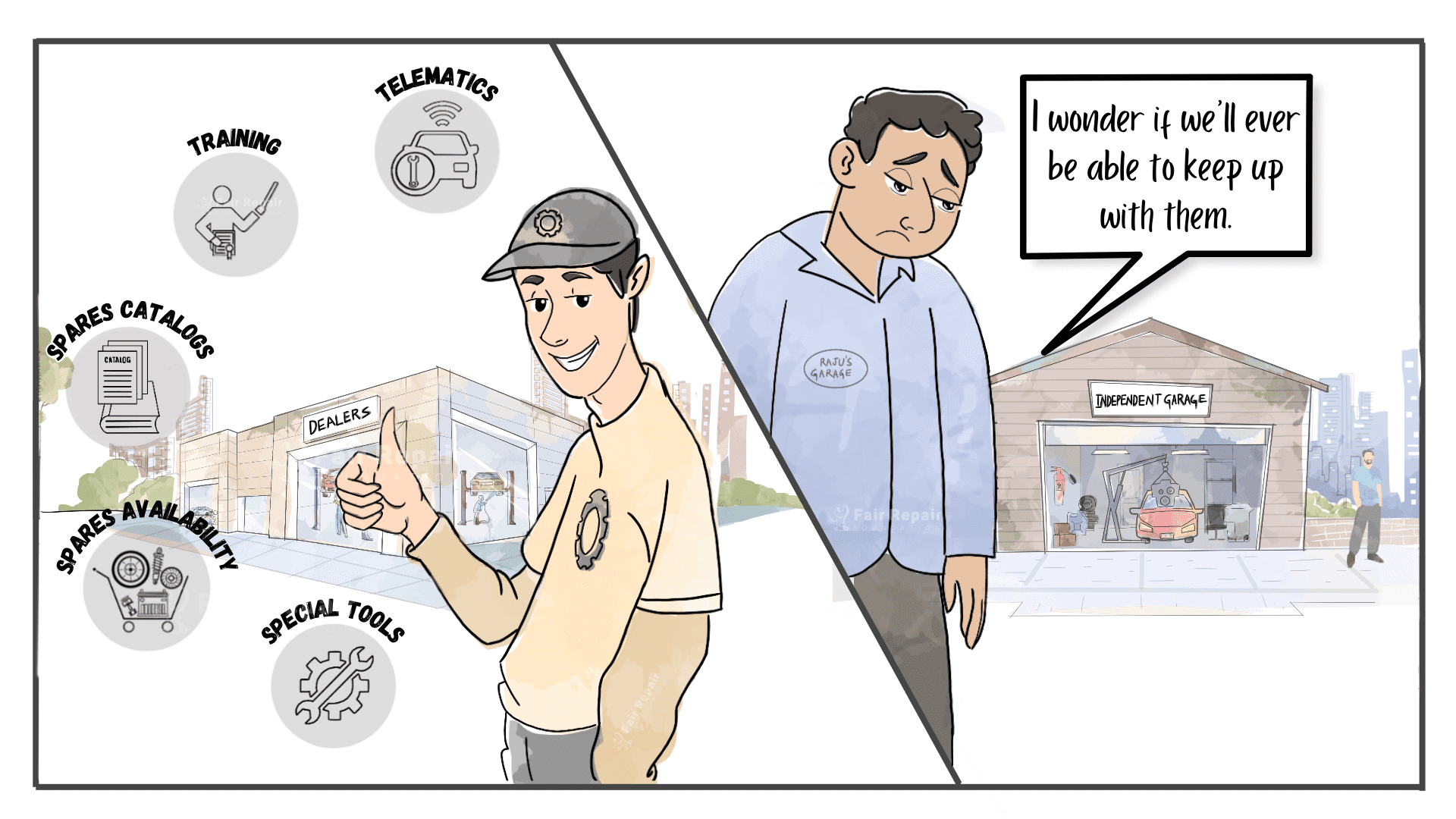

- The cost of processing auto claims is increasing due to high labour and repair costs at Dealers. Further, high in-flow at Dealers compounded by labour storages and supply chain issues is causing higher repair turnaround time – to the detriment of both the car owner and the Insurer.

- Due to the lack of competition in the automotive aftermarket, high repair costs at Dealers are reflected in higher insurance premiums for customers.

- Car Owners are troubled by lack of a repair options, particularly when collisions occur in remote areas, highways or Tier 2 / 3 towns where Dealers do not have presence.

- Due to high repair costs at Dealers, Car Owners are incurring higher out-of-pocket expenses to get their vehicles repaired.

- Insurers are finding it challenging to rely on the quality of spare parts and the repair procedures followed by the Independent garages.

- With the technological advancements in automobiles, Customers are expecting a drop in policy premium.

Why it matters to you?

- Due to the higher repair and spare part costs charged by the Dealer, your cost of processing a claim is high.

- The lack of competition in the automotive aftermarket and the monopolistic measures taken by the manufacturers is forcing you to charge higher premiums, thus impacting Customer satisfaction.

- Dealers aren’t spread across the country. A Car Owner seeking coverage in a remote location will have to go through the discomfort of travelling long distances to the Dealer for their repair and claim.

- Due to the lack of access to manufacturers’ digital catalogues, there is a difference in repair estimates submitted by the Dealer and Independent repairers, thus placing undue burden of verification on your surveyors and assessors.

- Independent repairers are restricted from accessing the repair procedures, spare parts, special tools and equipment needed to undertake the repair. Due to these restrictions by the manufacturer, you are forced to tie up with the Dealers for a reliable and quick repair – causing you challenges with turnaround time and costs.

- Advancement in technology puts you at a disadvantage and leaves you with no trained independent repairers to undertake repairs, further increasing your dependence on Dealers.

Life After Fair Repair

- With readily available spares in the open market, your cost for processing claims will reduce by greater than 20%.

- With more key players participating in the automotive aftermarket, the cost of spare parts will come down, thus lowering claim processing costs.

- You will benefit from choices between skilled Independent Garages and Dealer networks for the vehicle’s repair needs. Due to this, your cost of claims processing will reduce.

- With easy availability of manufacturer’s digital catalogues, you can now easily compare repair estimates from both Independent Garages and Dealers – leading to fast turnaround times on repair and hence satisfied policy holders.

- With access to spare parts, repair procedures, special tools, and diagnostic equipment, Independent garages will be ready to undertake repairs.

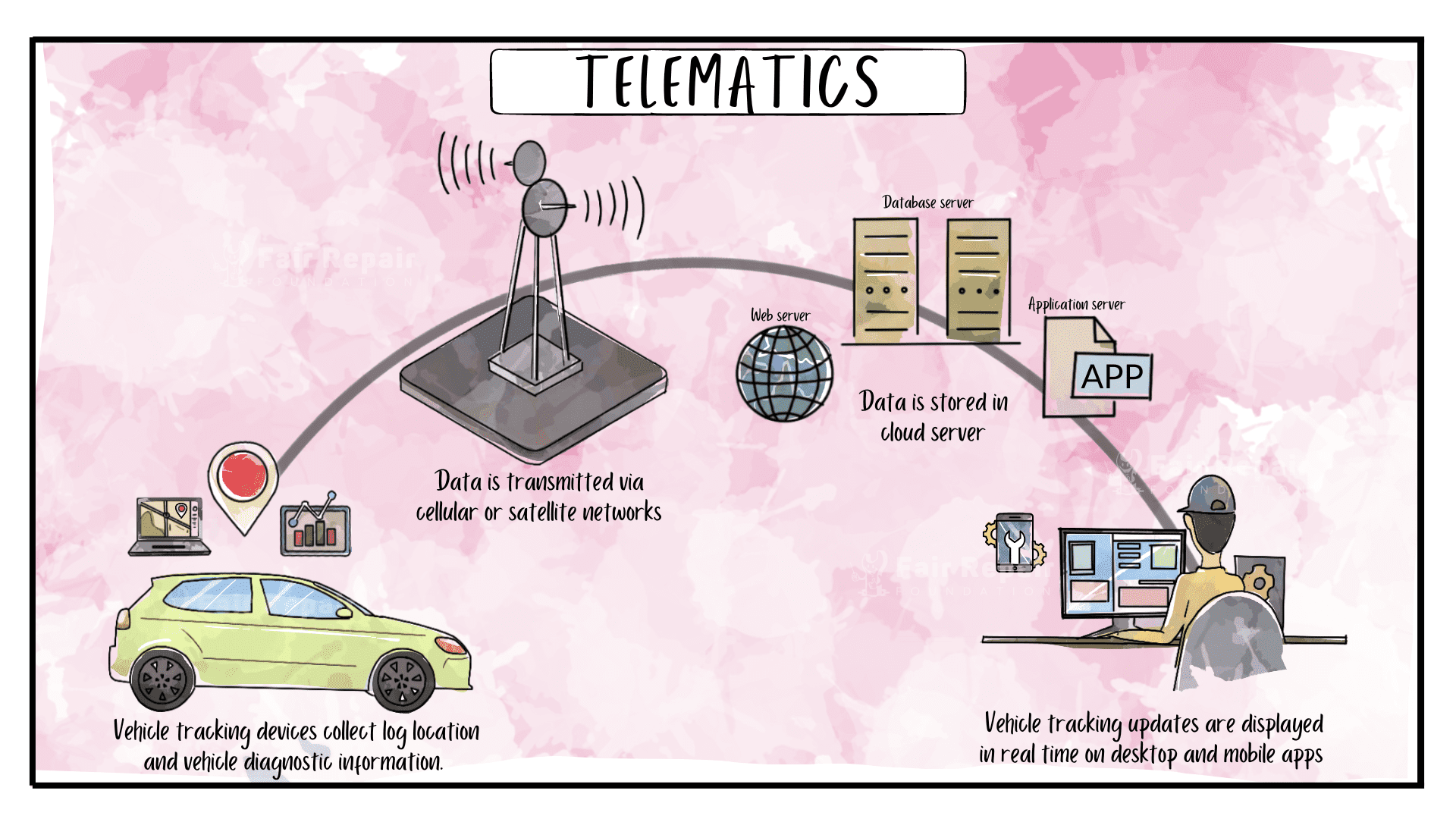

- With access to telematics, you can track your user’s data in real time, understand their behaviour and suggest policies best suited to them.